To help her sixth graders gain historical context, Intermediate Program faculty member Melanie Gibson devised a modern-day application: investing in the stock market. “Since we study the stock market crash of 1929 and its effects on the 1930s, I want the girls to have an understanding of what the market is about and how it works, and why it is so important to our economy,” said Gibson. “We discuss the difference between budget money and investment money. We also talk about the mistake that many people in the 1920s made by buying stock with their budget money and worse, buying stock on margin. Many were already in debt due to installment buying. These were just a few of the elements that led to the crash.”

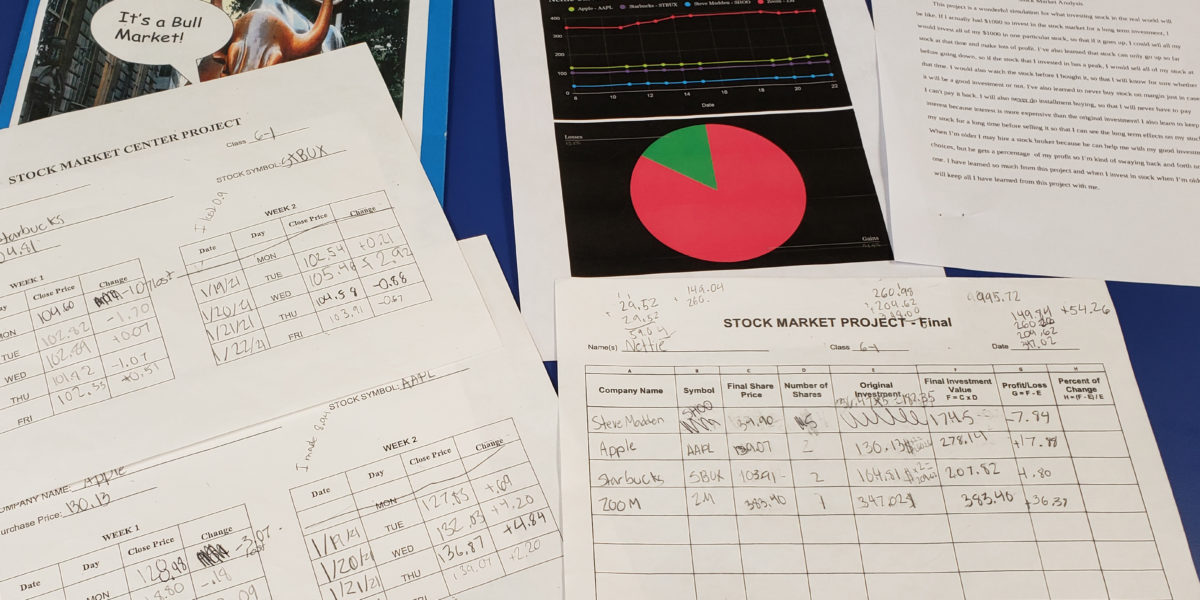

Allotted a hypothetical $1000, each student researched companies she believed had investment potential and examined past yields before selecting three or four companies to pursue. For two weeks, they tracked each day’s closing price and recorded their losses or gains. “We discussed that it is important to buy different types of stocks so that their portfolios are diverse; they might buy a tech stock, maybe a retail stock, or manufacturing,” noted Gibson. “This all leads to great discussion about smart investing, which did not happen in the 1920s.” At the end of the project, students wrote a paper to analyze their results and to reflect on the experience. For many, it was a chance to learn from history and prepare for their own futures. Several students shared the following:

“I learned that the stock market is extremely unreliable and you should not put your savings into stocks. I enjoyed choosing which companies to pretend to invest in. It gave me the opportunity to make my own decisions and prepare for investing in real life. Overall, I think learning about the stock market is not only an interesting topic, but it will serve me well in later years when I decide to invest my money.” —Elizabeth Brisson ’27

“I thought it was very fascinating how you could think one of your stocks was going to increase, but it ended up decreasing immensely. Something so small like the weather could affect the stock market and make it drop. I really enjoyed learning about the ways of the stock market and really love this project!” —Amelia Finnegan ’27

“When we finished recording in the two weeks, we added and subtracted our stocks to see how much we gained and lost in this time period. I lost $85 and gained $4. I really liked finding out how much I earned and gained in the end. I also liked making my bar graph when we finished. It is a very fun project, and I think Mrs. Gibson should do it every year.” —Quinley Winters ’27

“During this project we learned how to manage stocks wisely. I thought that seeing the market going down and up was fascinating, because it was like an economic roller coaster! I really enjoyed making the graphs, because it was fun to see the information more visually and how much money we made. Even if we weren’t really making money, it was still exciting!” —Leighton Staebell ’27

“Some of the activities that we completed were recording our stocks when the stock market closed (at 4:00 p.m.) and making two graphs on Google Sheets, one to represent our gains and losses and one to represent the stock price at closing. The most fascinating thing that I learned from this project was how the stock market affected The Great Depression.” —Nettie Carter ’27

“I loved how hands-on this project was, and I learned so much more about the stock market. Even though I’ve already invested a few hundred dollars in stocks, I only really began to see how complicated the process of it was. I love to ask inquisitive questions and really display my new-learned knowledge in handmade graphs. This fun experience was a great way to learn more about the complexities of the stock market and how you have to be smart with your choices.” —Veda Patel ’27